Editor’s note: Our recent article on marine insurance (see “Consequential DamageCoverage,” PS Jan. 2020) prompted many questions from readers regarding insurance for older boats. For answers, we turned to Mark Pellerin of BoatUS Marine Insurance Program (underwritten

by GEICO), who, in addition to answering these questions, offered this update

on changes in its depreciation terms. Depreciation and other policy details can vary greatly, so be sure to check your policy closesly to be aware of the terms of coverage. For more on marine insurance, see “A Sailor’s Guide to Marine Insurance,” PS October 2012).

Drew Frye’s “Consequential Damage Coverage (PS Jan. 2020) along with subsequent letters from Ron Russell (PS February 2020) and Gary Golden (PS March 2020) has put some focus on the issue of boat insurance. As a leading insurer of recreational boats and as one source for Mr. Frye’s story, we recognize that we can do better explaining coverages we offer. With some additional changes coming to all BoatUS Marine Insurance Program agreed value policies (underwritten by GEICO Marine Insurance), we’d like to take a moment to do that.

To address Mr. Russell’s concern, let’s look at the three types of things considered in an “agreed hull value” policy when a partial loss occurs: “hard goods,” “soft goods,” and “machinery.” Note that I am using these terms merely to explain, and this issue confirms that every boater needs to understand their individual policy coverages and terminology.

As owner of a 47-year-old vessel, Mr. Russell states, “I discovered that a change in underwriting at BoatU.S. Insurance meant that I had virtually no hull or damage insurance – despite increasing premiums. That is because, independent of any agreed value, the maximum the policy would pay for any damage was reduced by 10 percent for every year past 20 years of age.” He also asks, “If I lose the mast, or get T-boned by another boat while sitting peacefully at anchor, the policy pays only 20 percent of the actual cost of repairs, less deductible?”

As in the fictional T-bone scenario, fiberglass repairs (including hull damage) as well as damage to things including wood, masts, spars, paint, rails, stainless frames, aluminum T-tops – what would generally be considered “hard goods” – would be depreciated under the existing policy Mr. Russell discusses. To address some of these items, such as the mast, spars, fiberglass, railings and stainless frames, we put into effect an endorsement that waives depreciation on those items in the event of a partial loss. While we do our best to notify customers of this endorsement through customer communications, it is possible that Mr. Russell was not aware of this endorsement. [Editor’s note: Several readers said they were not aware of any option to waive depreciation. Other insurers, such as Chubb, exempt hulls from annual depreciation, even older ones, without the need for an added endorsement.]

Depreciation Categories

“Soft goods,” such as a canvas T-tops, canvas enclosures, fabrics, carpeting, cushions and sails, under Mr. Russell’s policy were formerly depreciated upon the twentieth year of manufacture. So if the T-bone accident had damaged his boat’s canvas enclosure (not its stainless frame), Mr. Russell was correct in that depreciation on his BoatUS (GEICO Marine Insurance) policy would reduce the insurance claim payout on these items “by 10 percent for every year past 20 years of age.”

However, starting in mid-March 2020 under the updated GEICO Marine Insurance agreed hull value policy, sails, canvas, carpeting, cushions and fabrics will factor in depreciation beginning with the sixth year from the year of manufacture. While we acknowledge this has been reduced from the twentieth to the sixth year of manufacture, we hope boaters understand that soft goods have the shortest life in the marine environment, and a depreciation waiver may be added to eliminate some depreciation. More on that in a moment.

Beyond “hard goods” and “soft goods,” “machinery,” such as engines, gensets and other onboard machinery were also formerly depreciated under Mr. Russell’s policy after the twentieth year of manufacture. In mid-March these items will see depreciation applied starting with the eleventh year of manufacture (with depreciation not greater than 80 percent).

Also starting in mid-March 2020, an updated, optional depreciation endorsement will eliminate depreciation for partial losses on both soft goods and machinery up to the twentieth year of manufacture. This will be available upon the policy’s inception and applicable to boats no more than 10 years of age. Current policyholders whose vessels meet the less-than-10-years-of-age requirement may also add this optional depreciation endorsement.

We will no longer offer a depreciation waiver for boats beyond 20 years of manufacture. Our goal is to provide a competitively priced policy while recognizing the cost challenges to replace “new for old” for soft goods more than six years old and machinery more than two-decades old. This approach to depreciation is similar to our policy prior to 2015, whereas instead of depreciation being applied to all partial losses after a certain amount of time, it will only be applied to specific items that do depreciate with use.

We encourage all boat owners to keep receipts documenting when equipment has been repaired or replaced as this can be a factor in reducing depreciation applied in the event of a partial loss.

Salvage Costs

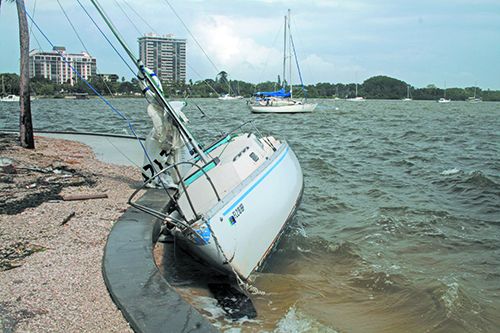

Looking ahead and acknowledging Mr. Golden’s comments that hurricanes are indeed “the largest source of financial loss to U.S. boat owners,” everyone should understand their policy’s salvage coverage fine print. When fires, sinkings, shed-roof collapses, or running up on a shoal damages your boat, you end up with a “salvage” situation. If the boat is not a total loss and needs to be recovered and brought to a repair facility, salvage costs can escalate quickly.

Most boaters assume the cost of raising or moving the boat to a safe location is covered by their policy, but some marine insurers will subtract salvage costs from the insured value of the boat, reducing the funds available to repair the boat or the amount paid in the event of a total loss. Also, in case of a total loss, you may only have a small percentage, perhaps just five or ten percent of the insured value, to pay for recovering the boat, which may not cover the entire salvage bill.

Better policies – including our agreed hull value policies – don’t let you go it alone and provide salvage coverage that is separate but equal to the boat’s hull value coverage. Better insurers also handle the salvage process for you and don’t simply cut a check and run. [Editor’s note: We found several insurers who cover complete salvage costs separately.]

Lastly, understand that half of all sinkings occur at the dock when some small part below the waterline fails. However, these parts – an outdrive bellows, for example – most often fail due to “wear, tear, and corrosion” or a lack of maintenance, so the policy won’t pay for a new outdrive bellows. But here’s the rub: As a consequence of the failed bellows, your boat has sunk and is likely a total loss. Who pays for that?

Depending on your policy, depreciation for soft goods can kick in fairly early in the boat’s life.

That’s why you need “consequential damage” coverage that pays for losses that often start with a failed part that may be excluded under the policy. The small, inexpensive part that failed may not be covered, but the rest of the repairs or total loss will be, as Mr. Golden said. One caveat: This consequential damage coverage often applies only to specific types of losses, for example, the immediate consequential damage resulting from any fire, explosion, sinking, dismasting, collision or stranding. These are the types of losses that typically cause a constructive total loss scenario.

Thanks for allowing us to explain and to further address some changes coming to our policy. BoatUS and other insurers can and do update their policies from time to time which may result in changes to coverages. It’s critical that every boater fully understands his or her boat’s insurance policy.

Mark Pellerin is an insurance expert with BoatUS Marine Insurance.

Allstate,

www.allstate.com

Atlass Insurance,

atlassinsurance.com

Boat Us (Geico),

www.boatus.com

Chubb,

www.chubb.com

Foremost,

www.foremost.com

gowerie (IMIS),

www.gowerie.com

Nationwide,

www.nationwide.com

Boat US/ Geico marine no longer insures boats over 40 years old witch left me high and dry after having insurance through Boat US for over 25 years. Now I an stuck shopping for insurance and paying for a survey. When I got insurance through Boat US i was told if the decided the boat ever needed a survey in the future they would pay for it. Seems pretty Shady to me!

Did you find a company I have a 54 hatteras from 1973 that looks brand new and can’t find insurance?

As a long time Boat US member I called about insurance on my 1986 hatteras and was told they could not insure the boat because it was too old. It is becoming increasingly difficult to find insurance at all and of course marinas and boat yards want to see proof of insurance. Another case of insurance companies controlling how people live.

Remember

If you are going to sink…….sink deep

The salvage guy always gets paid first and it comes out of your cut

progressive will insure it, however, I had to under-insure my 48 chris craft at $40K to get it covered and make the marina happy. The ugly part was a 30% increase next year. Really, when you have a big boat nothing gets cheaper. Travelers dropped me after 20 years 2 years ago. The Progressive on line policy build is really cool.

Thanks for the tip!

Our homeowners policy covers a 1986 33′ sailboat, 1976 22′ sailboat, and a 1995 19′ IO with riders at additional premium of about $300/year.